Mobile continues to drive growth in European digital advertising

Last week, IAB Europe, the leading European-level industry association for the digital marketing and advertising ecosystem, released its full 2018 AdEx Benchmark Report. The report, now in its thirteenth year, is the definitive guide to advertising expenditure in Europe, with this study covering 28 markets.

First published in Mobile Marketing Magazine, The AdEx Benchmark report author, Dr Daniel Knapp, chief economist at IAB Europe provides insight into the state of the European mobile advertising market on the back of the report.

25 July, 2019, Mobile continues to drive growth in European digital advertising

This July, IAB Europe published the latest edition of its annual AdEx Benchmark report on the state of the European digital advertising market. The report, which focuses on market performance over 2018, brings together facts and figures from across Europe relating to growth, and delivers a breakdown of spend across digital advertising formats.

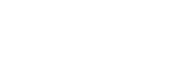

The top-line figures for the overall market show that the entire European digital advertising sector grew by 13.9 per cent in 2018, which represents the fastest growth in the sector since 2011. Digital remains a significant driver for growth in the overall paid-media advertising market and now accounts for 45 per cent of the total. Between inception of the AdEx Benchmark study in 2006 and this year’s index, the market added €48.5bn in annual value.

Mobile increases market share of display

Where does mobile advertising fit into this picture? Mobile advertising first made a truly significant impact on the digital advertising market back in 2013, when it accounted for a double-digit share of digital spend for the first time. By 2017, mobile was one of the key drivers behind growth in display spend.

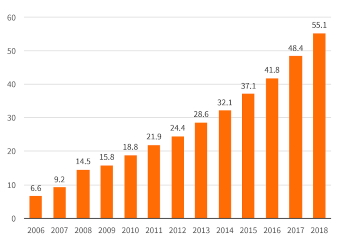

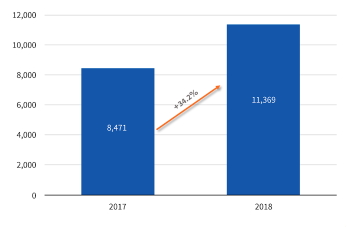

In 2018, mobile continued to drive growth. Overall, mobile display advertising spend grew by 34.2% to reach €11.4bn. This growth means that mobile accounted for 48.9 per cent of total spend in display advertising.

The strong performance of mobile display is in contrast to desktop display, whose share dropped to 51.1 per cent in 2018 from 57.2 per cent in 2017.

The growth of mobile display is largely due to the continued proliferation of social media and improved targeting options. The growth in optimised mobile pages from publishers has also played a part, as has the use of ad campaigns to drive app installs. Gaming apps were a particularly strong driver for growth in mobile display and we saw large gains recorded by app developers in this space.

The growth of mobile display is largely due to the continued proliferation of social media and improved targeting options. The growth in optimised mobile pages from publishers has also played a part, as has the use of ad campaigns to drive app installs. Gaming apps were a particularly strong driver for growth in mobile display and we saw large gains recorded by app developers in this space.

Looking at the regional breakdown, the growth leaders are mostly emerging markets such as the Czech Republic (105 per cent) and Ukraine (65 per cent). However, Germany also demonstrated a surge in mobile display growth, coming second in the rankings at 65.4 per cent. Overall, mobile display spend is dominated by Western European countries, particularly the UK, which accounts for €4,759m of the total (almost four times as much as the second biggest spender, Italy, which accounted for €1,051m). Of note is the fact that 13 markets are now mobile-first (i.e. the share of spend on mobile exceeds that of desktop).

Mobile search spend trends upwards

Mobile search spend trends upwards

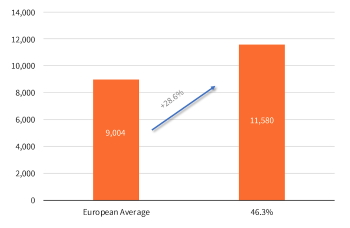

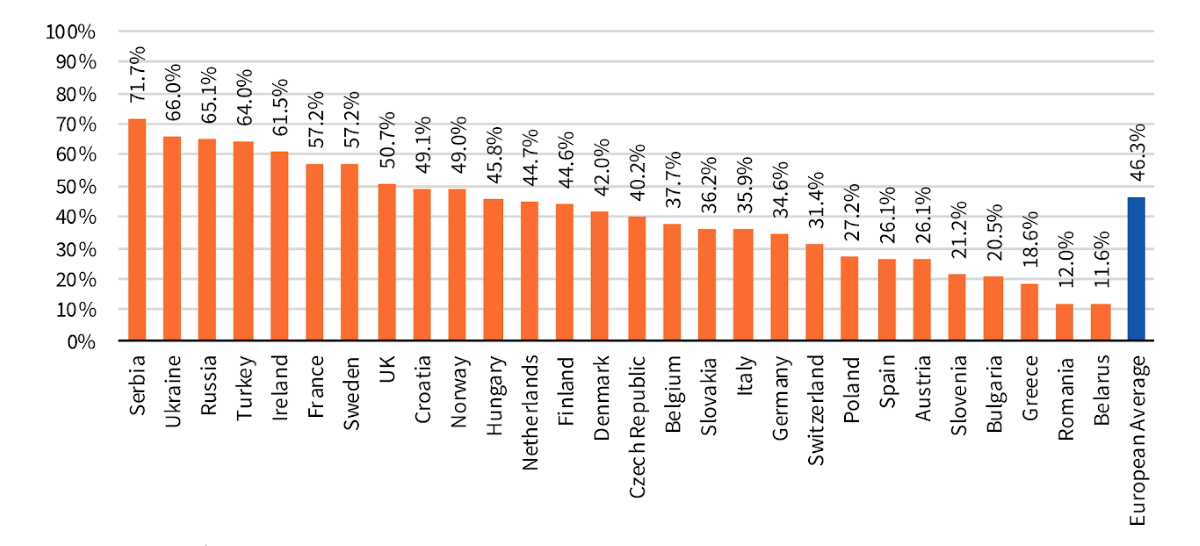

Mobile also performed well in the search space, growing 28.6 per cent in the year to total €11.6bn. This represents an increase of market share of 5.8 per cent on 2017 (40.5 per cent vs. 46.3 per cent), bringing it closer to spend on desktop search. While this is a lower share of the market than in mobile display, it accounts for €0.2bn more in actual spend due to the larger size of the market.

Higher ad rates were a driver of growth in this market. This is significant because historically rates for mobile search have lagged those for desktop. And while the share of mobile spend still trails the share of mobile searches by around 10 per cent, the gap is closing. Mobile search also benefited from higher mobile search volumes overall, helped by better integration with maps and changing consumer habits.

Higher ad rates were a driver of growth in this market. This is significant because historically rates for mobile search have lagged those for desktop. And while the share of mobile spend still trails the share of mobile searches by around 10 per cent, the gap is closing. Mobile search also benefited from higher mobile search volumes overall, helped by better integration with maps and changing consumer habits.

In this category, nine of the ten largest markets are in Western Europe (with the exception of Russia, which ranks fourth). The fastest-growing markets are once again in Eastern Europe, with the Czech Republic (70.6 per cent), Belarus (54.4 per cent) and Ukraine (44 per cent) leading the pack. Eight markets are now mobile-first (i.e. where spend on mobile has overtaken desktop), with the top ten in terms of mobile share coming from a mix of Western and Eastern European nations.

Across all formats, mobile ad spend is still catching up to changed media consumption habits, especially outside of the social platforms. As the social share of digital ad spend begins to plateau, this is where new pockets of growth are emerging. The ascent of digital audio advertising around music streaming and podcasts, is also predominantly mobile. This will be further fuelled by the proliferation of connected cars in the years ahead.

Across all formats, mobile ad spend is still catching up to changed media consumption habits, especially outside of the social platforms. As the social share of digital ad spend begins to plateau, this is where new pockets of growth are emerging. The ascent of digital audio advertising around music streaming and podcasts, is also predominantly mobile. This will be further fuelled by the proliferation of connected cars in the years ahead.